FXStabilizer is a Forex expert advisor that is compatible with MT4 and MT5 trading terminals and can trade in 8 different currency pairs. It claims to earn stable profits daily. However, it is not wise to invest in a system without doing some research.

This product is powered by Forexstore.com. We know nothing about the parent company and its service history. The vendor has shared the official address of the headquarters and the identities of the traders and developers have not been revealed. We don’t know if this team has developed other expert advisors in the past.

The highlights of FXStabilizer

According to the seller, these are the special features of this trading system:

Dual-mode settings

There are two modes for this EA, namely Ultimate and Pro. The Ultimate version trades in 6 currency pairs while the Pro version supports 8. There are durable and turbo trading modes for Ultimate. With the Pro version, you get all the features of Ultimate along with an additional license. The Durable mode is supposed to provide stable profits, but the live results tell us otherwise.

Stable monthly profits without losses since 2015

The vendor makes the tall claim that the robot hasn’t suffered any failures since 2015. However, this is not entirely true, and we can confirm this by studying the live performance. It is not a sign of a reliable vendor to make unrealistic promises such as there.

Hard drawdown control

Both the Ultimate and Pro versions have a hard drawdown control feature. The vendor has not provided an adequate explanation for this feature, so we don’t know what technique the EA uses for controlling the drawdown. As we can see from the trading results, the robot has not been too successful in keeping the drawdown low.

Trading strategy

The 8 currency pairs traded by this robot are EUR/USD, AUD/USD, EUR/JPY, USD/JPY, USD/CAD, GBP/CHF, EUR/GBP, and CHF/JPY. Oddly enough, the vendor has not explained the trading strategy behind this expert advisor. Without strategy insight, it becomes very difficult to trust this robot.

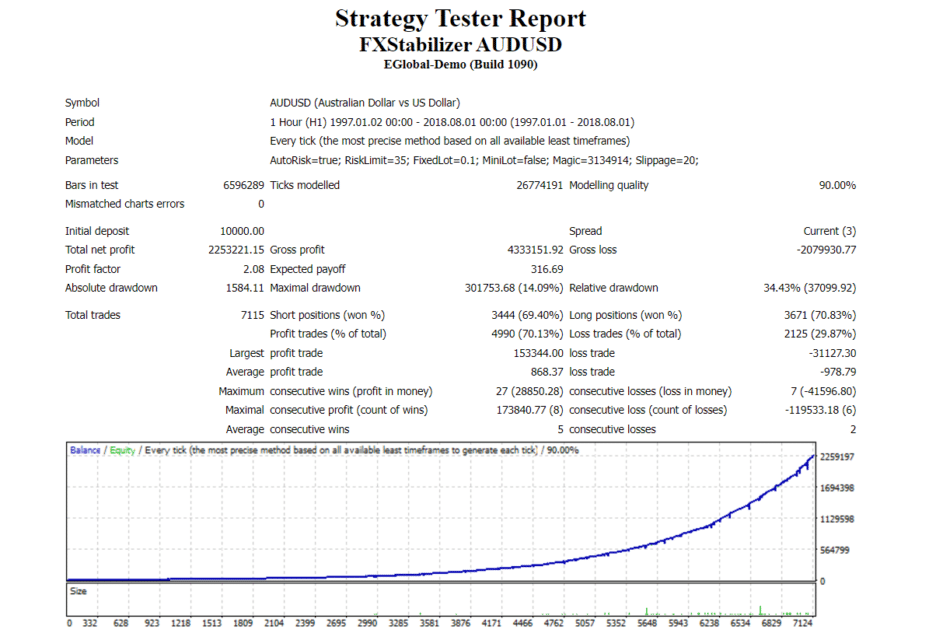

Backtesting reports

This backtest was conducted from 1997 to 2018 using an every tick model. The EA placed 7115 trades during the testing period, winning 70.13% of them and generating a net profit of $2253221.15. It had a relative drawdown of 34.43%, and this indicates a high risk of ruin. The profit factor for this backtest was 2.08.

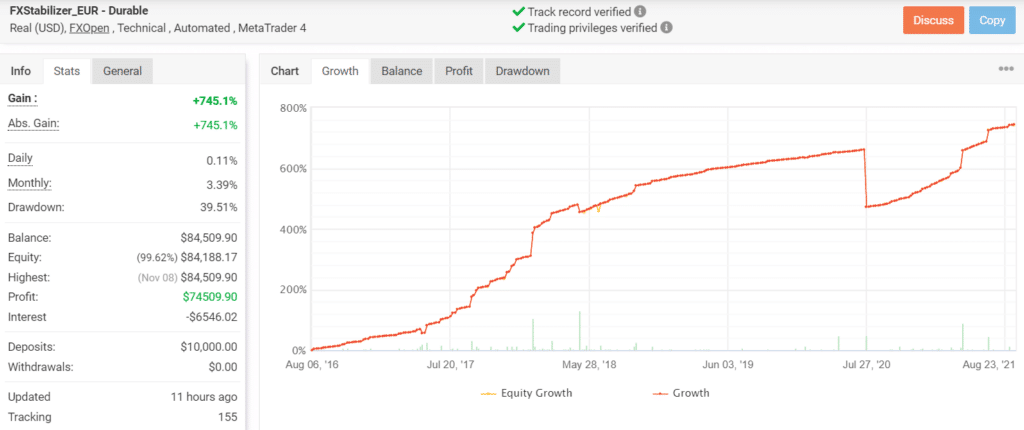

Trading results in real time

Since August 2016, FXStabilizer has placed 681 trades through this account. It has a win rate of 60%, but as we can see, the performance dipped drastically during the month of July. The total profit generated through this account is $74509.90. It has a drawdown of 39.51% which is slightly higher in comparison to the backtesting data.

The risky trading strategy is very apparent for this expert advisor. In the trading history, we can see several consecutive losses. This tells us that the robot follows a high-risk trading approach. While using this system for live trading, users may incur heavy losses.

FXStabilizer price

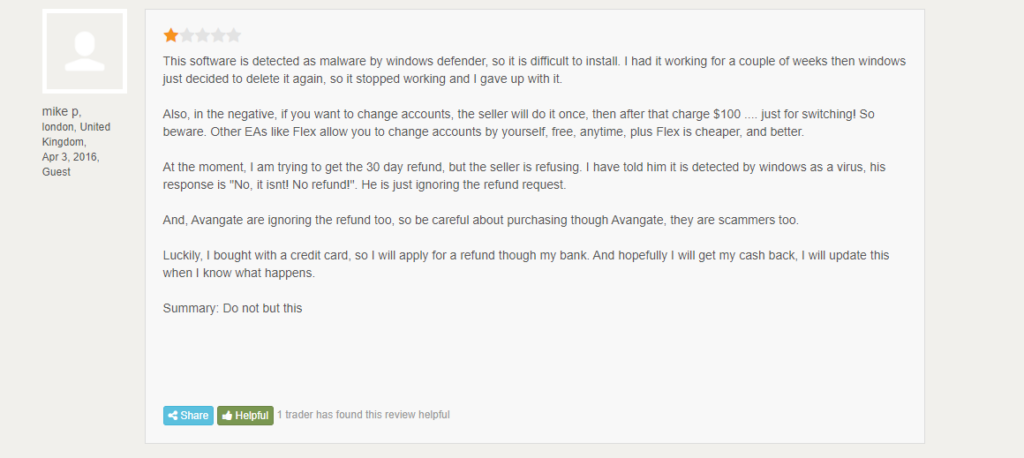

Both the Ultimate and Pro versions carry hefty price tags. You can purchase these EA modes for $539 and $739 respectively. It makes no sense to invest this much money for a robot that uses a risky trading strategy and is sold by a vendor we don’t know much about. The vendor offers a 30-day money-back guarantee for this EA.

Customer support

There is no official contact information on the website. There is a contact form that lets you send a message along with your name and email address. We can only assume that the service team then reaches out to you via email.

Are traders happy with FXStabilizer?

On the Forex Peace Army website, there are a total of 7 reviews for this expert advisor. One customer has complained that the software is hard to install since Windows defender considers it malware. They have also claimed that the vendor refuses to provide refunds.

FXStabilizer

FXStabilizer-

Functionality3/5 Neutral

-

Trading Strategy2/5 Bad

-

Live Results3/5 Neutral

-

Customer Support2/5 Bad

-

User Reviews1/5 Awfully

Advantages

- Verified trading results

Disadvantages

- High drawdown

- Lack of strategy insight

- Lack of vendor transparency