Forex Imba is an expert advisor that was released in 2014. The presentation is 3 pages long and doesn’t include information about settings and features. We don’t know why the developers avoided sharing more robot’s features with us. There’s no legally registered company behind the service. The devs don’t have other trading solutions mentioned.

The highlights of Forex Imba

We have prepared a list of settings, features, and our explanations to let you make a wise decision about whether to work or not to work with the robot.

- The system works completely automatically on the client’s terminal.

- The advisor has been working on the real account for 8 years.

- It has to provide us with stable profits.

- The balance requirements are low: $60 to get started.

- We don’t know what time frame we have to work with.

- The installation process takes not so much time.

- We have to work with fixed lot sizes for our safety.

- It doesn’t use Martingale to recover.

- There’s drawdown control on the board.

- The trading is possible on any broker house.

- We can switch an account online many times.

- The developers provide us with a user manual.

- There’s a welcome and knowledgeable support available.

The list of features that can be useful for trader using Forex Imba is as follows:

Money management

The advisor works with lost sizes, margin, TP, and SL levels.

Avoiding using Martingale

The system doesn’t use such risky strategies such as Martingale.

Drawdown control

It can work well with cutting drawdowns before it becomes too late.

Trading strategy of Forex Imba

- We don’t know details about the strategy.

- The robot can trade only two symbols: AUDUSD and EURUSD.

- We have no information about time frames.

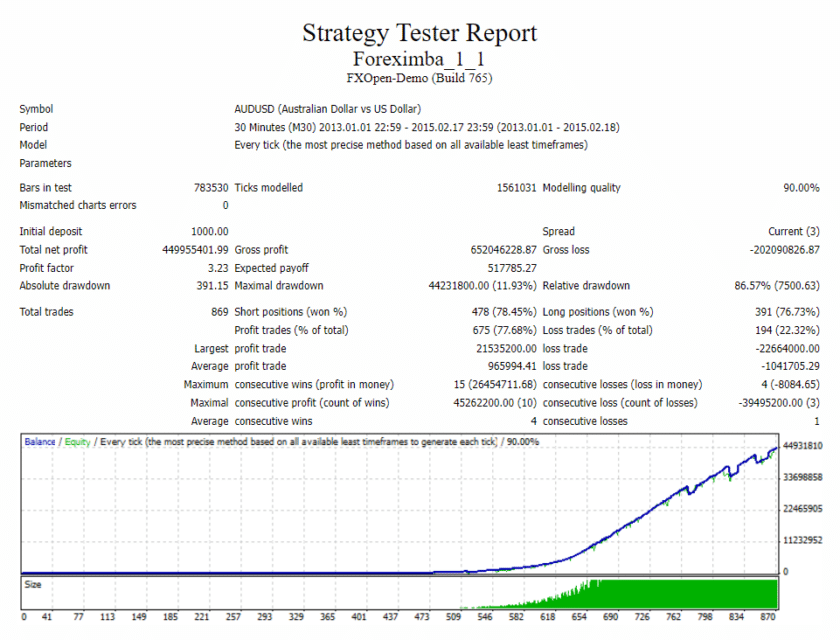

Backtesting reports

We have an AUDUSD backtest provided on the M30 time frame. The modeling quality was only 90.00%. The system was tested with spreads of three pips. An initial deposit was $1000 that has become $449,955,401 of the total net profit. The profit factor was 3.23. The expert advisor has executed 869 orders. The maximum drawdown was 11.93%. It’s a good number. The win rate was 78% for shorts and 76% for longs.

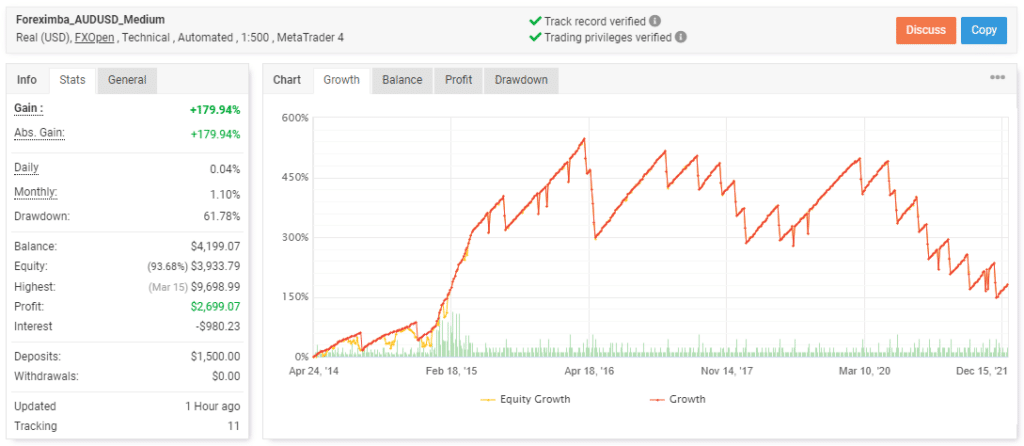

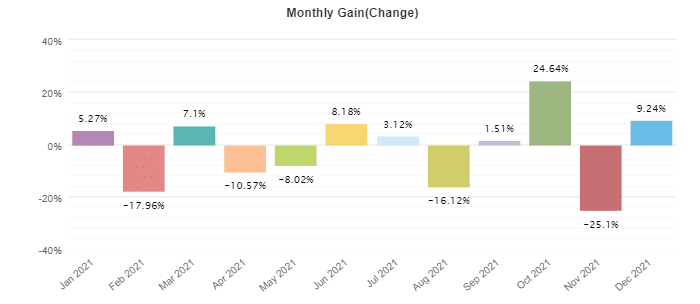

Trading results in real time

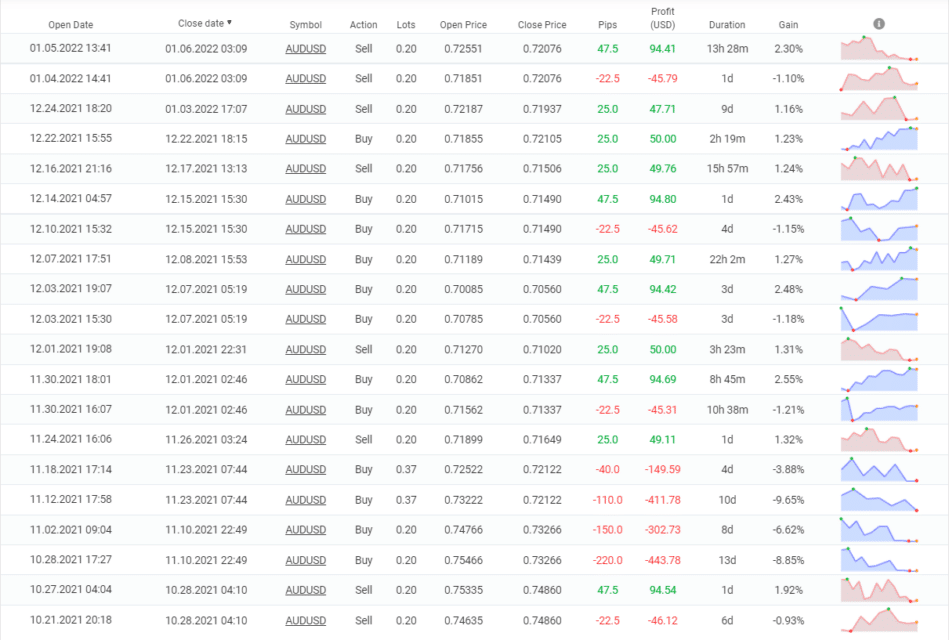

We can see the system working on the real account for 8 years. It uses FXOpen to trade automatically on MT4 with 1:500 leverage. The advisor receives technical indicator data from a terminal. The account has a verified track record. It was found on April 24, 2014, and deposited at $1,500. Since then, the total gain has become 179.94%. The growth chart doesn’t look trustworthy and promising at all.

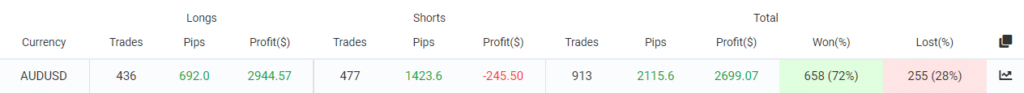

The advisor traded 913 deals with 2115.6 pips. An average win is 28.16 pips when an average loss is -64.36 pips. An average trade length is three days. The profit factor is 1.07.

The advisor does use Martingale because the short direction was lost -$245.50 but 1423.6 pips were gained.

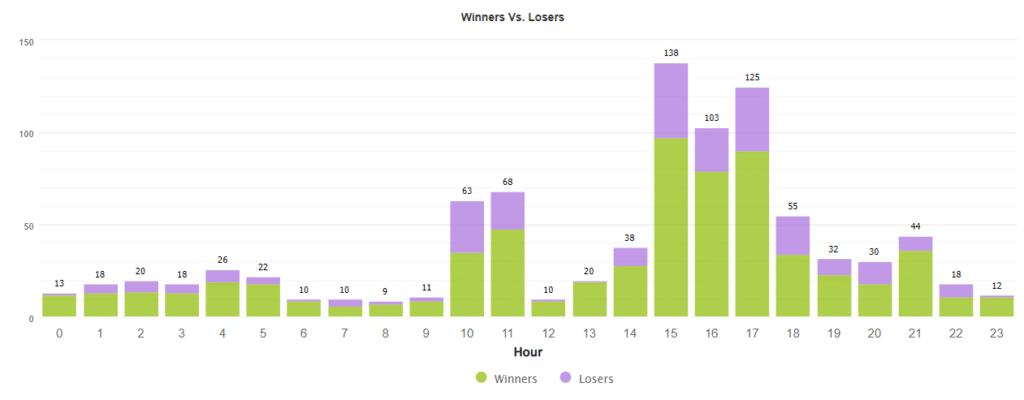

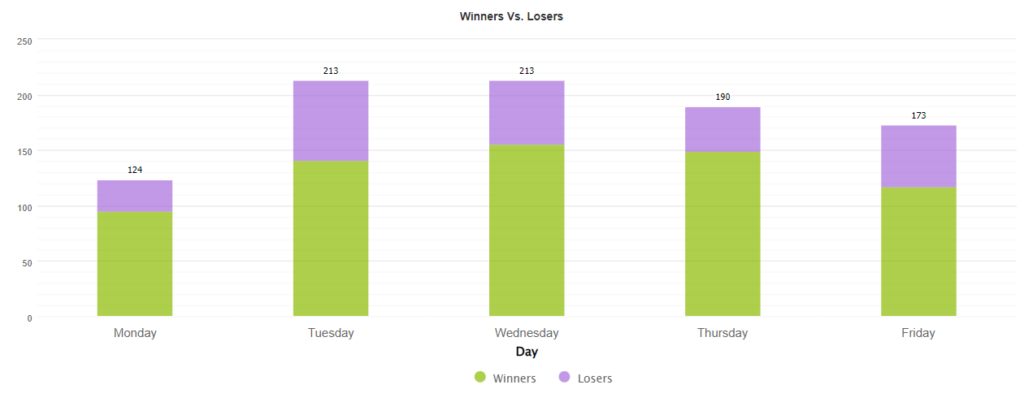

The European hours are the most traded.

Tuesday (213) and Wednesday (213) are the most actively traded days.

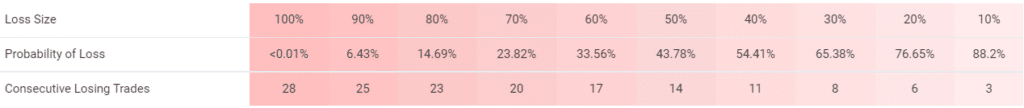

The advisor works with huge risks to the account balance. There’s a 88.2% chance of losing or 3 orders lost to lose 10% of the balance.

The advisor works not only with Martingale but with a Grid of two orders also.

Trading results in 2021 were predictable and profitable.

Forex Imba price

The offer doesn’t look professional because we have only one price for a real account copy – $194.99 and no explanations about the package’s features at all. We can only rely on a 30-day money-back guarantee.

Customer support

We don’t know how well their support is because no testimonials were written about it.

Are traders happy with Forex Imba?

The developers provide no testimonials. So, we don’t know either.

People say that Forex Imba is …

There’s a profile of Forex Imba created on Forex Peace Army. There has been no testimonials written about the system for 8 years. It looks suspicious.

Forex Imba

Forex Imba-

Profitability2/5 Bad

-

Strategy2/5 Bad

-

Reliability1/5 Awfully

-

Price3/5 Neutral

-

Customer Testimonials1/5 Awfully

Advantages

- Backtest reports provided

- Trading results shown

- A 30-day refund policy applied

Disadvantages

- No team revealed

- No risk advice given

- No strategy details revealed

- No settings explanations provided

- The advisor trades horrible

- No people testimonials written