Forex GDP is a signals provider service that offers live signals along with chart analysis. The traders generating the signals have been in the industry for more than two decades. They have been providing signals to traders worldwide since 2015.

The team behind this system has worked with top Forex brokers, fund managers, financial institutions, and trading platform administrators. The vendor has not revealed the identities of the traders, so we can’t confirm that they have the adequate expertise to provide profitable signals. Also, we don’t know where the parent company is based. It is unclear whether this team has other signal services.

The highlights of Forex GDP

Here are some of the main features of this platform:

Free signals

There is a free plan for this platform. You don’t need to register with a particular broker or pay any hidden fees to get these signals. The signals are not long-term, unlike the paid plans. There are 4 signals provided for each month, with the profit target being over 150 pips.

Performance history

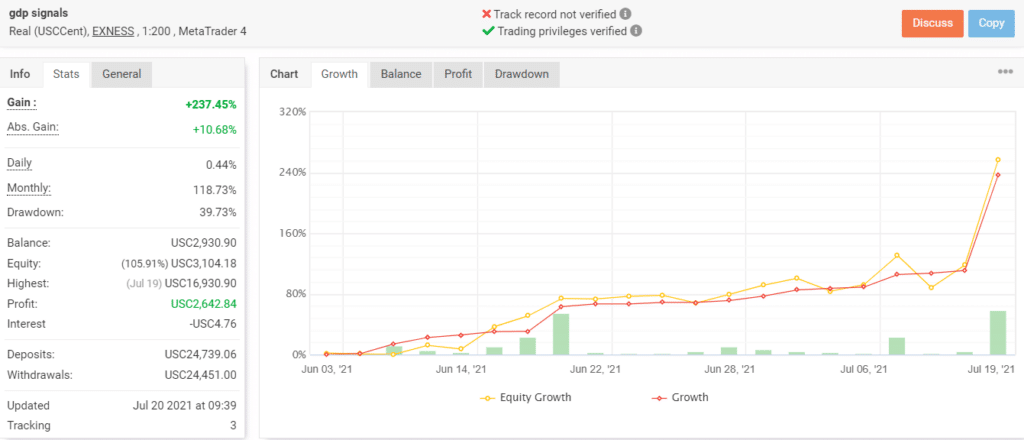

Forex GDP has a live trading account on Myfxbook. Here, you can check the account history to verify the results. Nevertheless, the account exhibits a high drawdown, so it is clear the signals are quite risky.

News analysis

The paid signals come with news analysis. These signals follow crucial financial updates that affect the prices of currency pairs.

Copy trading

Those with very little experience in Forex trading can choose to copy the trades of pro traders. This requires you to pay a certain fee for each order or a portion of the gain.

Trading strategy of Forex GDP

The users get to see the logic behind each long or short trade. The various types of signals include Big Trade, Commodity, News Trading, Jackpot Entry, and Trend Reversal. Big trade signals are based on major predictable price movements. Commodity signals are for gold, silver, crude oil, and other commodities. News Trading signals are based on fundamental economic factors.

Jackpot Entry signals are low-risk and high-reward. The risk-reward ratio for these signals is 1:5 or 1:10. For the Trend Reversal signals, the analysts identify a major trend reversal and confirm it from the major level.

The signals generated by this platform are based on multiple strategies like Scalping, Grid, Swing, Day Trading, Trend Trading, Position Trading, Carry Trading, etc. Users receive the signals via messaging applications on their mobile phones.

Backtesting reports

Backtesting results are important for automated trading systems because they show us the long-term performance. Since this is a signals provider and not an expert advisor, the vendor has not shared the backtesting data.

Trading results in real time

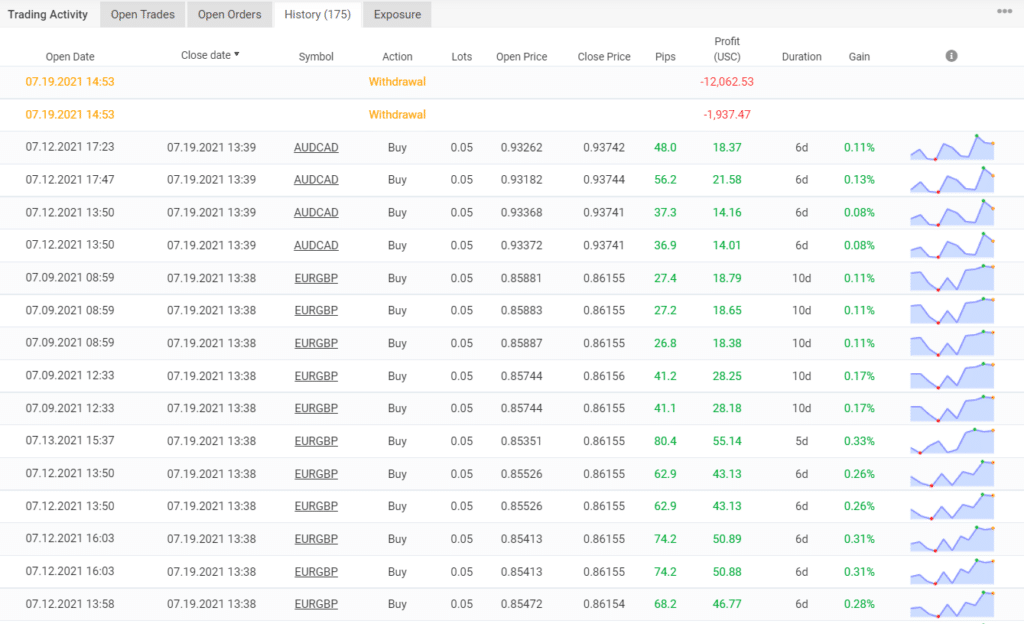

This live trading account on Myfxbook was launched on June 03, 2021. The account was last updated on July 20, 2021. Thus, it was active in the live market for quite a short period of time and the owner has not placed any trades through it recently. The win rate for this account is 86%, based on just 168 trades. While the daily and monthly gains are 0.44% and 39.73%, respectively, the drawdown is quite high at 39.73%, indicating a risky strategy.

From the trading history, we can see that the robot trades with a fixed lot size of 0.05. The average holding time for an order is five days, while the average win and loss are 57.60 pips/USC20.64 and -35.82 pips/-USC 13.70, respectively.

Forex GDP price

There are two paid plans for this service, namely Premium and Supreme. The monthly charges for these plans are $74 and $147, respectively. This is not cheap by any standards and there is no refund policy.

Customer support

You can get in touch with the support team via email, Skype, or the contact form on the website.

Are traders happy with Forex GDP?

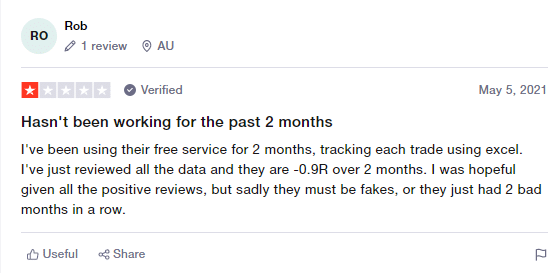

There are several user reviews for this service on Trustpilot. One user has claimed to have had two consecutive losing months with this provider.

Forex GDP

Forex GDP-

Profitability2/5 Bad

-

Strategy3/5 Neutral

-

Reliability2/5 Bad

-

Price2/5 Bad

-

Customer Testimonials2/5 Bad

Advantages

- Multiple strategies

Disadvantages

- Discontinued trading results

- Lack of vendor transparency

- High drawdown