Breaking Equity is an advanced and efficient trading platform offering a plethora of functionalities aimed at assisting traders in enhancing their investment yields. This platform encompasses features such as algorithmic trading, a variety of technical indicators, thorough backtesting capabilities, and extensive automation options, equipping traders with the necessary resources to make well-informed investment choices. This evaluation delves into the various aspects, benefits, and potential limitations of Breaking Equity to assist you in deciding if it suits your trading needs.

Platform Features

Breaking Equity offers a holistic array of tools to aid traders in boosting their investment returns, including:

- Algorithmic Trading: This feature allows users to implement their trading tactics automatically, based on set rules and criteria, facilitating trade execution without the need for ongoing supervision.

- Range of Technical Indicators: The platform includes a broad spectrum of technical indicators like moving averages, Bollinger Bands, and MACD, customizable to align with individual trading strategies and offering insights into market trends.

- Backtesting Capability: A key component for strategy assessment, Breaking Equity’s backtesting tool is both user-friendly and adaptable, letting traders test their strategies against past data.

- Automation of Trades: This function enables the execution of trades based on specific, pre-set rules, thereby diminishing human error and enhancing efficiency.

- Intuitive Interface: The platform’s interface is straightforward and easy to navigate, ensuring traders have access to all the necessary information for making well-informed investment decisions.

- Educational Materials: Breaking Equity also provides a variety of educational content, including articles, videos, and other tools to help traders stay informed about market trends and hone their trading skills.

Algorithmic Trading

Algorithmic trading, or automated trading, involves the use of computer programs for executing trades based on specific rules and parameters. This technology allows traders to bypass constant market monitoring and helps minimize the risk of human error.

Breaking Equity’s algorithmic trading feature offers simplicity and customization, enabling traders to build their strategies using various technical indicators and charting tools. Once a strategy is established, the algorithm can autonomously execute trades based on the set criteria.

The advantages of algorithmic trading include improved speed and efficiency, reduced error risk due to emotional factors, and the ability to test strategies against historical data. This feature allows traders to swiftly respond to market changes and seize opportunities as they arise, making it a valuable asset for enhancing investment returns on Breaking Equity.

Technical Indicators

Technical indicators are analytical tools based on asset price and/or volume, employed to assess market trends and guide investment decisions. Breaking Equity offers a diverse array of technical indicators customizable to individual trading preferences.

Some of the technical indicators available on Breaking Equity include moving averages, Bollinger Bands, RSI, MACD, and Fibonacci retracement levels. These tools can offer critical insights into market movements, such as potential buy or sell signals, support and resistance levels, and market volatility trends.

Customizable technical indicators on Breaking Equity allow traders to tailor their analysis to fit their specific investment strategies, offering a more bespoke trading approach. Utilizing these indicators, traders can gain a deeper understanding of market movements and make more informed investment choices.

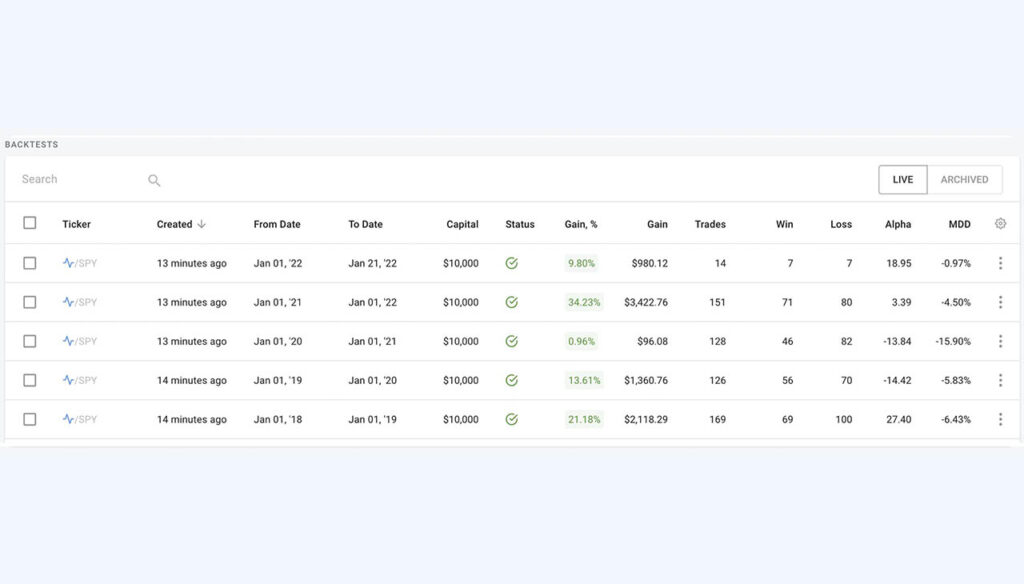

Backtesting

Backtesting involves testing a trading strategy against historical market data to assess its viability. Breaking Equity’s backtesting tool is user-friendly and highly customizable, permitting traders to test their strategies using historical data.

This feature allows traders to gauge how their strategies would have fared under various past market conditions, helping them fine-tune their approaches for future investments. Breaking Equity’s backtesting tool is flexible, enabling adjustments in timeframes, technical indicators, and risk management settings, allowing traders to understand the impact of specific strategy modifications.

Overall, Breaking Equity’s backtesting tool is a vital resource for traders to evaluate their strategies and make more informed investment decisions, leveraging historical data to mitigate the risk of costly errors and enhance returns.

Automation

Automation is a central aspect of Breaking Equity’s trading platform, aimed at reducing human error and maximizing investment yields. This feature permits automatic trade execution based on established rules and criteria, eliminating the need for continuous monitoring.

Traders can create automated rules using technical indicators, chart patterns, and other criteria. The platform then executes trades automatically when these conditions are met, ensuring no missed investment opportunities.

Automation’s benefits include heightened efficiency, reduced risk of emotional error, and the capability to quickly adapt to market changes. By automating the trading process, traders can capitalize on opportunities as they present themselves, unbounded by the limitations of manual trading.

User-friendly Interface

Breaking Equity’s platform boasts an intuitive and navigable interface, delivering all the necessary information for informed investment decisions. The design allows for high customization, enabling traders to personalize the experience to suit their specific needs and strategies.

The interface is streamlined for ease of use, offering clear data visualizations for quick insight into market trends. Traders can modify the dashboard to display pertinent information, including technical indicators, chart patterns, and news feeds.

Furthermore, Breaking Equity’s interface comprises various tools like backtesting, automation, and technical analysis, accessible directly from the dashboard, providing traders with resources to optimize their investment returns.

Educational Resources

Breaking Equity provides a range of educational materials to help traders stay current with market trends and enhance their trading skills. These resources encompass articles, videos, webinars, and other tools offering insights into the trading realm.

The educational content on Breaking Equity covers various topics, including technical analysis, risk management, market trends, and investment strategies. These resources are accessible directly from the dashboard and can be tailored to individual learning needs and interests.

Additionally, Breaking Equity features a community forum where traders can exchange experiences and perspectives, offering a valuable learning and networking opportunity.

Summary

Summary-

Automated trading5/5 Amazing

-

User-friendly interface5/5 Amazing

-

Educational resources4/5 Good

-

Limited availability4/5 Good

The Good

- Automated trading feature

- User-friendly interface

- Educational resources

The Bad

- Limited availability outside the US and Canada