Wall Street Forex Robot is a scalping-based trading advisor. The developing company is FXAutomater. It has some reputation among the traders and investors.

The highlights of Wall Street Forex Robot

Let’s talk about settings, features, impart any details and other information.

- The system can execute orders completely automatically for us on the terminal.

- It can be used on any broker.

- We can work with low spreads.

- There are accounts allowed to trade with Standard, Mini, and Micro.

- We are free to work with 4 and 5 digit brokers.

- The system follows NFA rules.

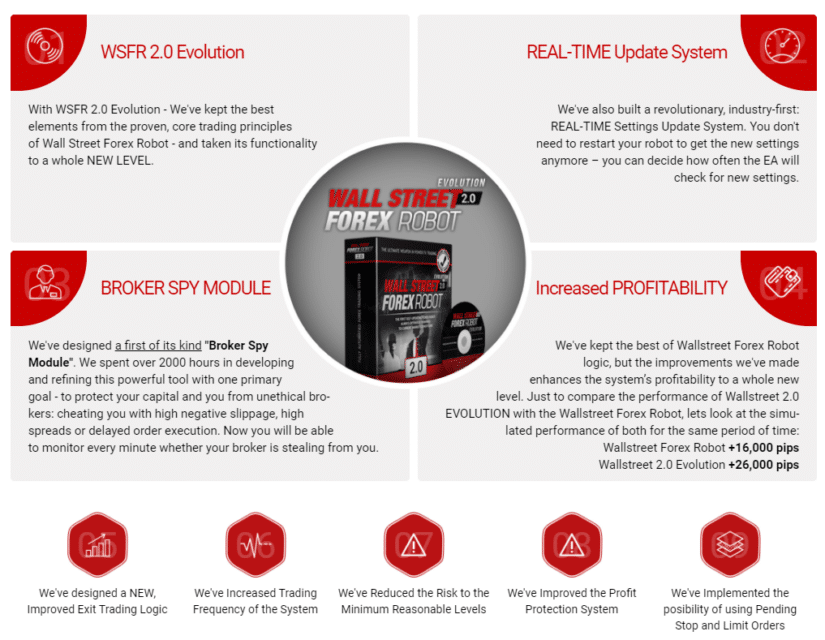

- There’s a broker spy module. It prevents fraudulent actions on the broker side.

- It can update itself when it executes orders.

- The system was updated to 2.0 version.

- We have an advanced exit trading logic implemented.

- It opens orders with high frequency.

- It sets pending stop and limit orders to catch a market move.

- An average profit is 10-15 pips.

- We can complete the installation within 10 minutes.

- The pack will include several free advisors.

According to the vendor, the below-listed features set the robot apart in the market:

Money management

The system calculates entry points, stop loss and take profit levels for us. It opens and closes orders automatically.

Generates some of the monthly income

The system closes some profitable months from time to time.

Drawdown control

There’s drawdown control applied. It prevents the account from reaching Margin Call levels.

Trading strategy of Wall Street Forex Robot

- The system scalps little profits from the market.

- It trades the following currency pairs USD/CHF, GBP/USD, NZD/USD, USD/CAD, EUR/USD, USD/JPY, and AUD/USD.

- It may probably work on the M15 time frame, according to the backtest.

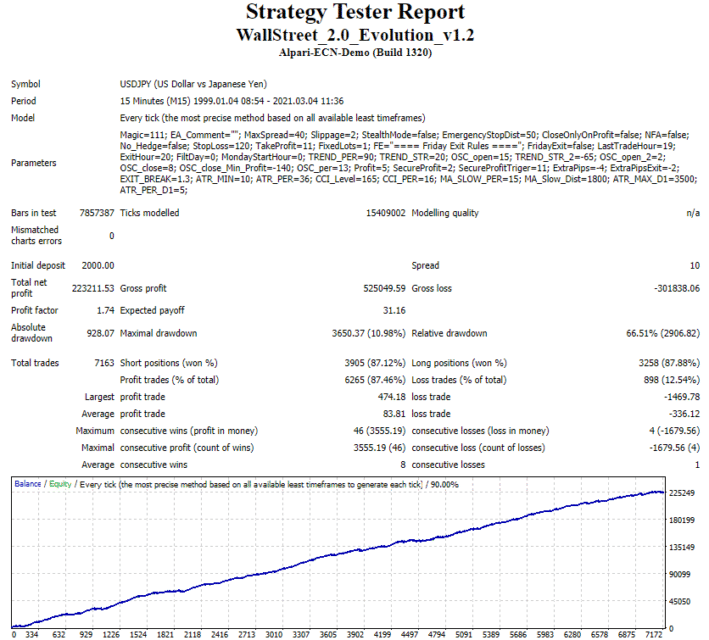

Backtesting reports

The presentation includes some backtests provided. It’s a USDJPY test on the M15 time frame. The data period was over 21 years. The modeling quality wasn’t mentioned. The spreads were 10 pips. An initial deposit was $2000 when the total net profit was $223,211. The profit factor was 1.74. It executed 7163 orders with an 87% win rate in both directions.

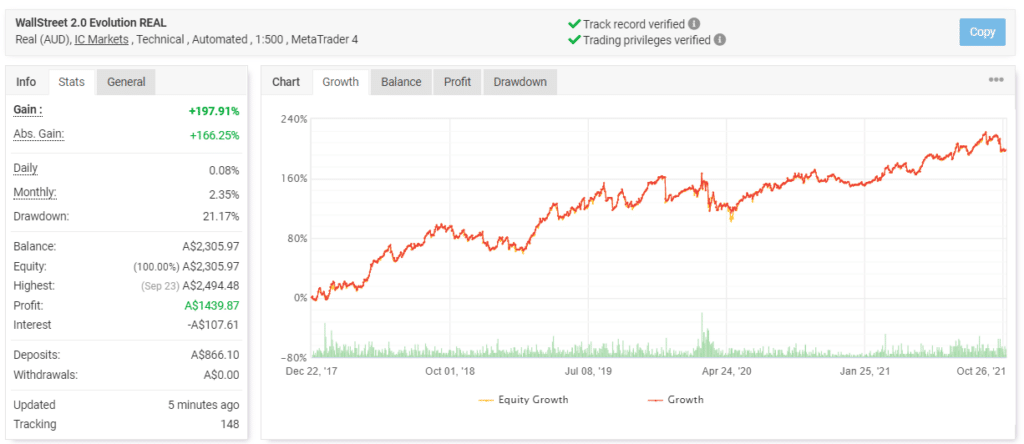

Trading results in real time

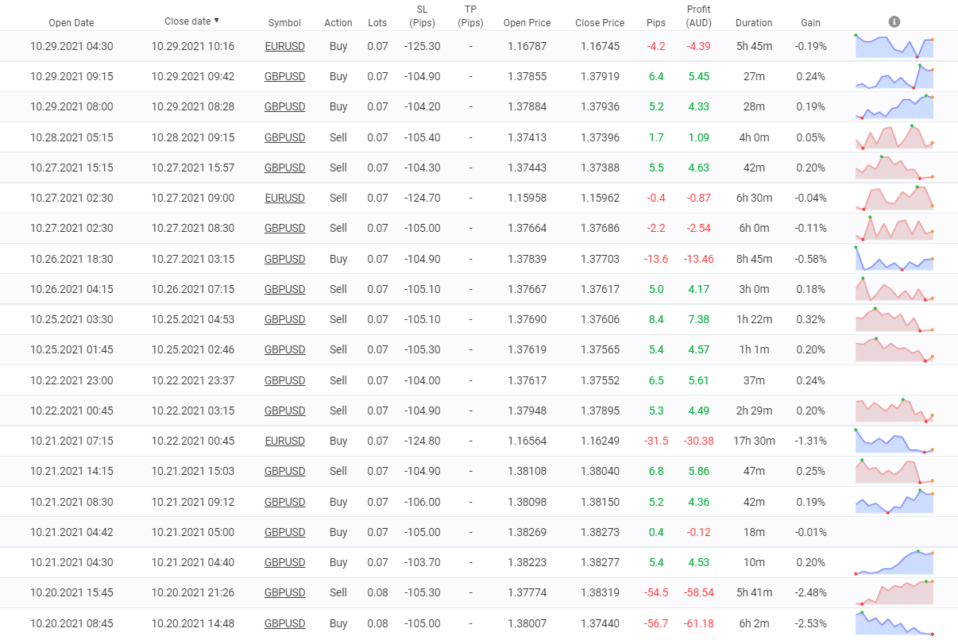

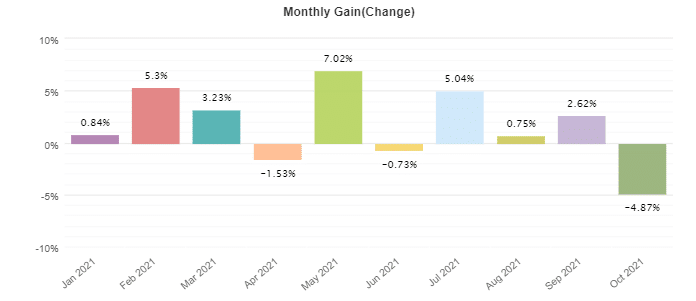

The robot keeps trading on a real AUD account on IC Markets automatically with 1:500 on MT4. The account has a verified track record. It was created on December 22, 2017, and deposited at A$866.10. Since then, the absolute gain has become 197.91%. An average monthly gain is 2.35%. The maximum drawdown is 21.17%. One hundred forty-eight traders track results.

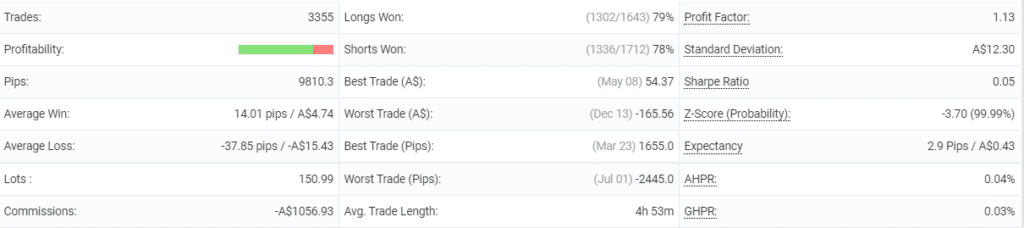

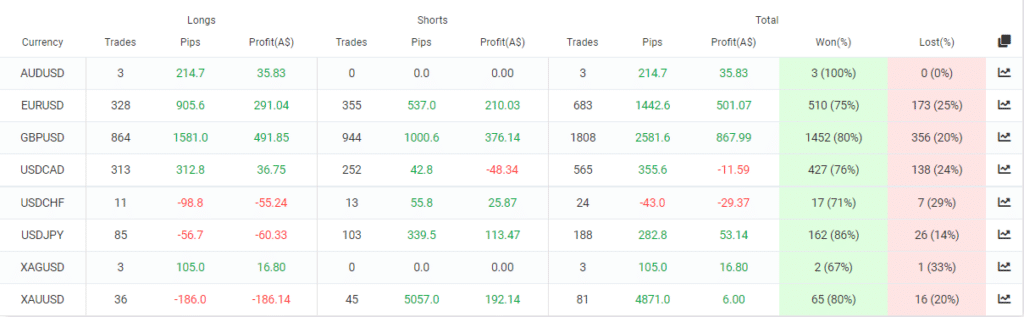

The system has traded 3355 orders with 9810 pips. An average win is 14.01 pips when an average loss is -37.85 pips. An average trade length is 4 hours 53 minutes. The profit factor is low – 1.13.

GBPUSD is much ahead in trading activities and profitability, 1808 orders with $867.99.

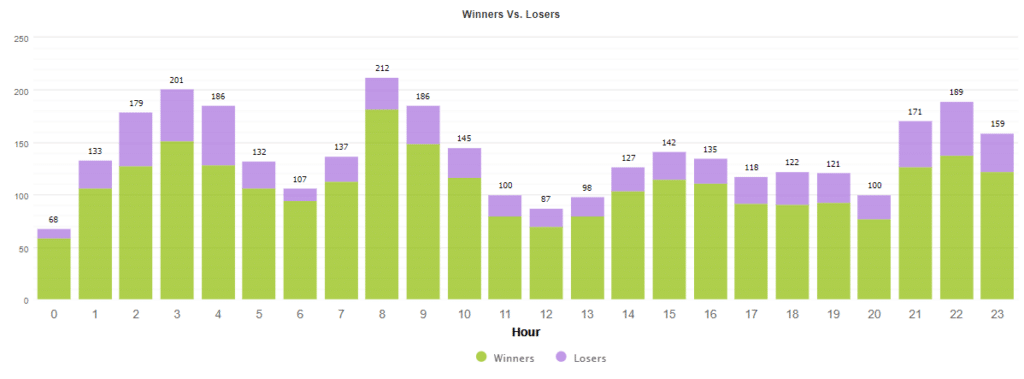

The robot works during all seasons, but focuses on the Asian and the beginning of the European trading sessions.

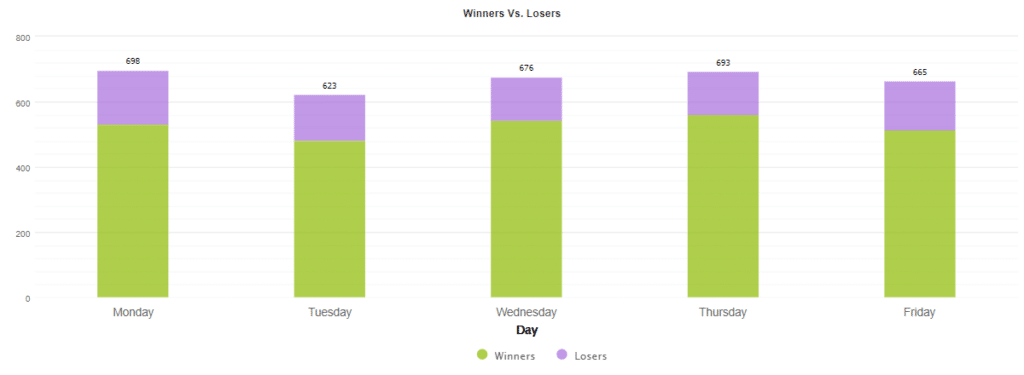

The advisor executes orders equally during a week.

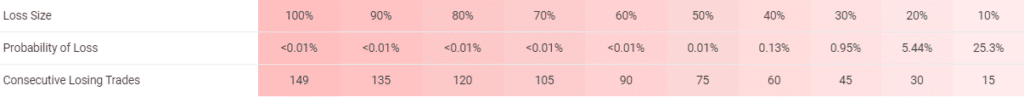

It works with medium risks to the balance. There’s a 25.3% chance to lose 10% of the account.

The system doesn’t use Martingale to recover.

It looks like October 2021 will be lost.

Wall Street Forex Robot price

The vendor provides us with a -$80 discount.

The system is available for $267 instead of the main price of $347. We have explanations about the pack: a license for real account trading, an unlimited number of demo account licenses, the best in Forex industry 24/7 support, a 60-day refund policy, WS Asia, Recovery Pro, and Gold Trader advisors for free.

Customer support

FXAutomater has one of the best, if not the best, support on the Forex market. They are welcome and provide us with the relevant information.

Are traders happy with Wall Street Forex Robot?

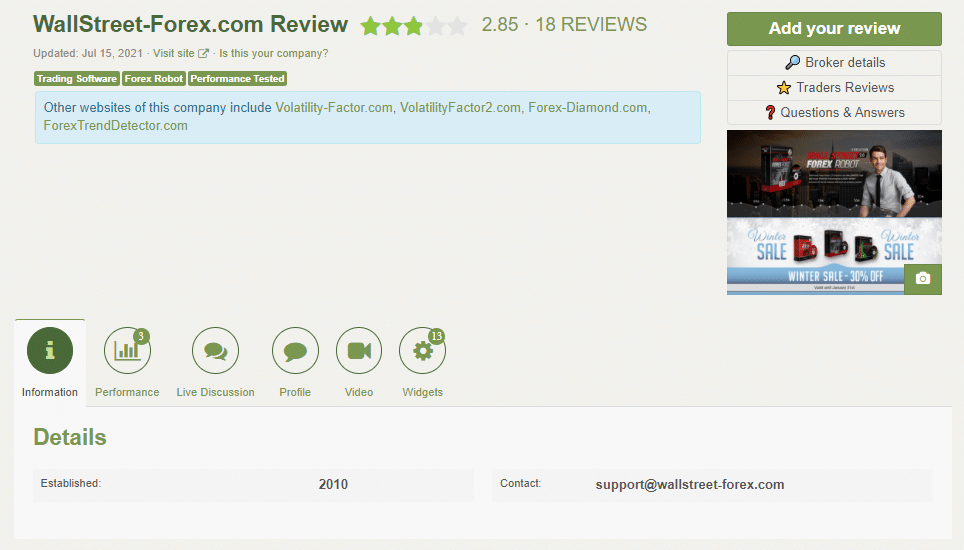

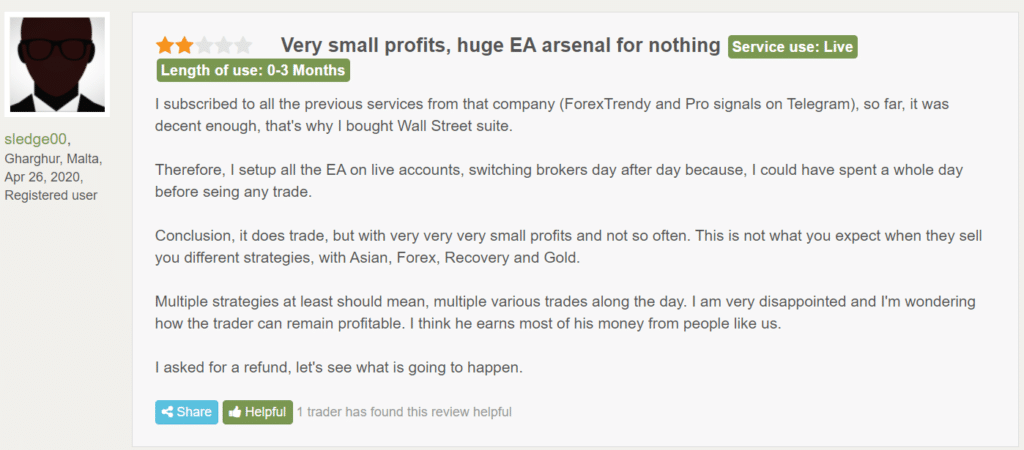

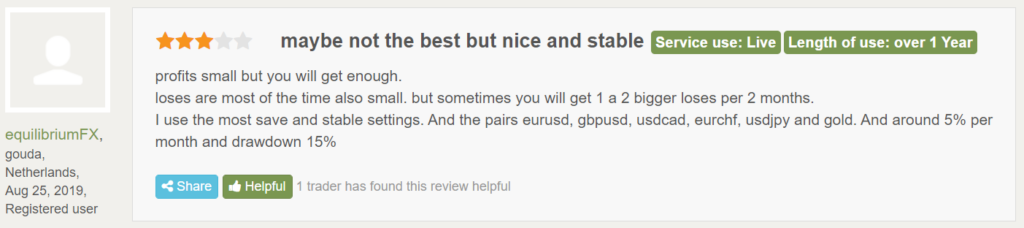

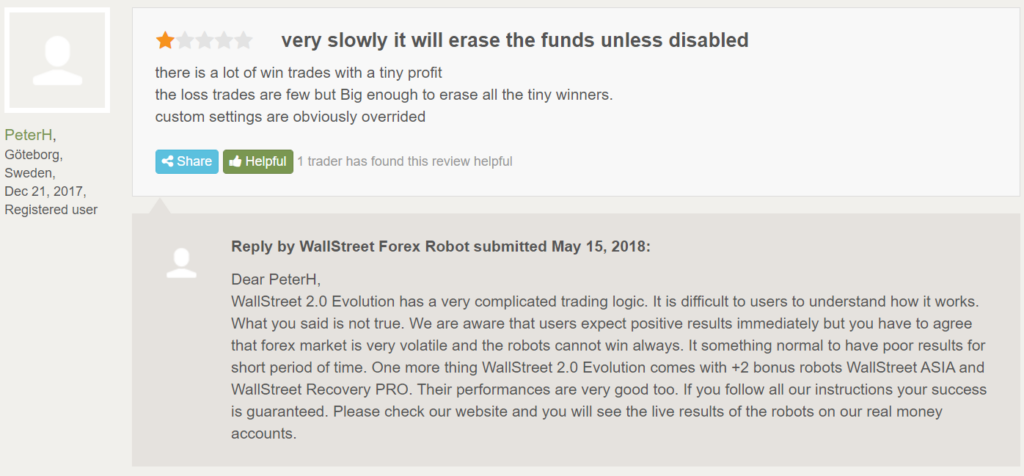

Wall Street Forex Robot has a page on Forex Peace Army. There were 18 reviews posted that formed a 2.85 rate.

There were many negative reviews written. The system performed poorly and couldn’t be customized properly.

Wall Street Forex Robot

Wall Street Forex Robot-

Profitability3/5 Neutral

-

Strategy3/5 Neutral

-

Reliability3/5 Neutral

-

Price4/5 Good

-

Customer Testimonials3/5 Neutral

Advantages

- Well-known designer

- Backtest reports provided

- Trading results shown

Disadvantages

- No risk advice given

- No settings explanations provided

- Unpredictable trading results

- There are many negative testimonials written