GerFX Density Scalper is a trading advisor that focuses on scalping profits from the market. We can purchase the robot from the MQL5 community. The dev behind this trading tool, Paul Exler, claims that the system is optimized in a few ways to reduce slippage. So, we have decided to check its settings and other details to decide whether it is worth $2K.

The highlights of GerFX Density Scalper

The presentation provides us with explanations about how the system works and what we have to expect from it.

- The robot can cover us with executing orders on our terminal automatically.

- The developer provided us with proper customization files.

- The core time frame to work is H1.

- It can manage deals on the M5 either.

- We have to customize the risks properly in order not to lose much.

- It places SL levels for every deployed order.

- The system needs the best possible broker conditions.

- We can purchase MT4 and MT5 versions.

- The robot is a fully customizable trading solution.

- The advisor doesn’t work with risky strategies like Martingale and Grid.

- Trading is possible on EURUSD, GBPUSD, EURCHF, USDCHF, USDCAD, EURCAD, EURAUD, AUDUSD, AUDNZD, AUDCAD, CHFJPY, (experimental: USDJPY, EURJPY, EURGBP, EURNZD, GBPAUD, NZDUSD, NZDCAD).

- GMT offset will be customized automatically.

- We have to use it on VPS.

- We should test it on the data with real spreads.

- The system has to avoid trading during high impact news.

There are the core features of GerFX Density Scalper

Simple trading system

The robot covers us with placing and closing orders automatically. So, it may be a good choice even for those traders who have very little to no trading experience.

Money management features

The advisor places SL and TP levels to protect our account from rough moves.

Welcome support

We can rely on welcome and knowledgeable support.

Trading strategy of GerFX Density Scalper

- The core strategy is Scalping. It focuses on cutting out short profits from the market moves. It requires low spreads, slippages, and commissions.

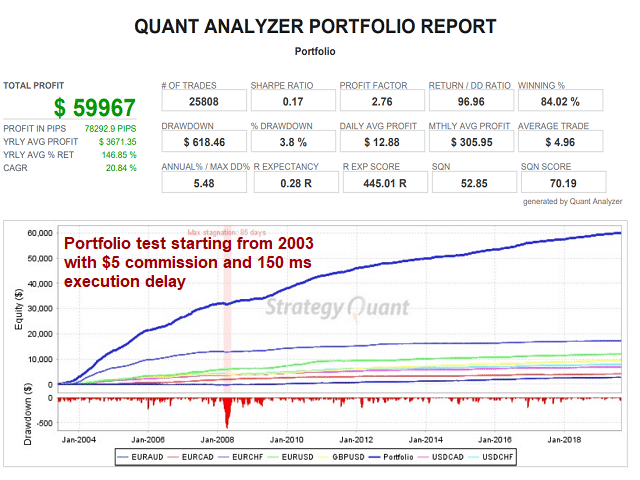

Backtesting reports

We have a backtest report that united seven cross pairs. The system could generate $58.966. There were gained 78292 pips. The profit factor was 2.76. The win rate was over 84%. The maximum drawdown was pretty low–3.8%.

Trading results in real time

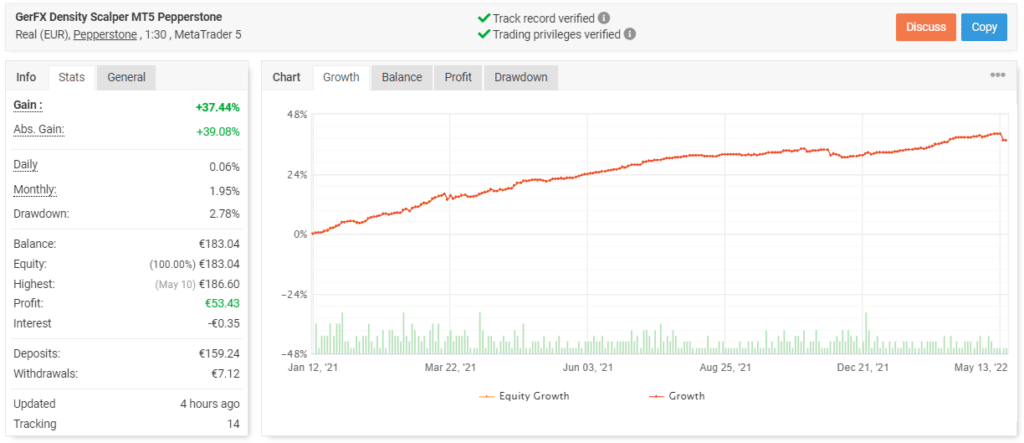

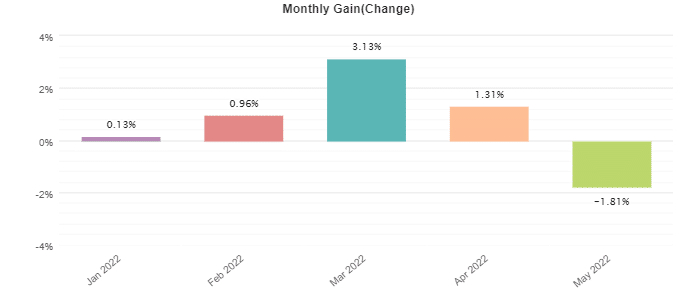

The robot manages orders on a real EUR account on the Pepperstone on the MT5 platform. The developers keep a high level of trasnparency providing all details of this account. The account was created on January 12, 2021, deposited at €159.24, and withdrawn at €7.12. Since then, the total gain has become 37.44%. An average monthly gain is 2.25%. The maximum drawdown was 2.78%.

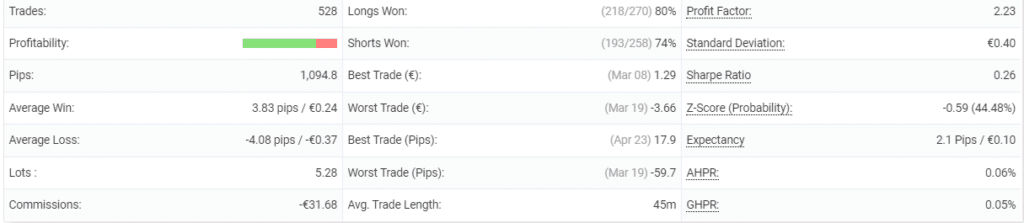

The robot closed 528 deals and 1094.8 pips obtained. An average win is 3.83 pips when an average loss is -4.08 pips. The system trades with an average trade length of 45 minutes. The profit factor is 2.23. These numbers look acceptable.

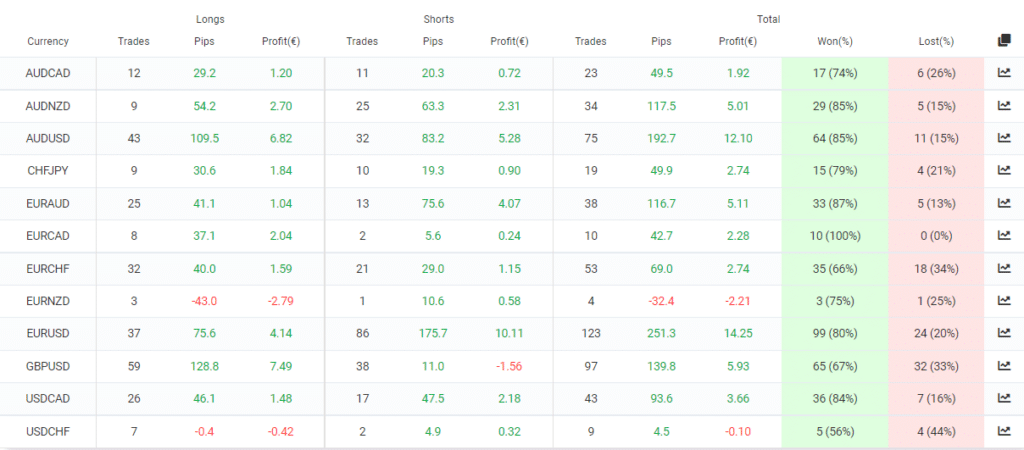

There are twelve pairs on the board. EURUSD with 123 orders are the most traded days.

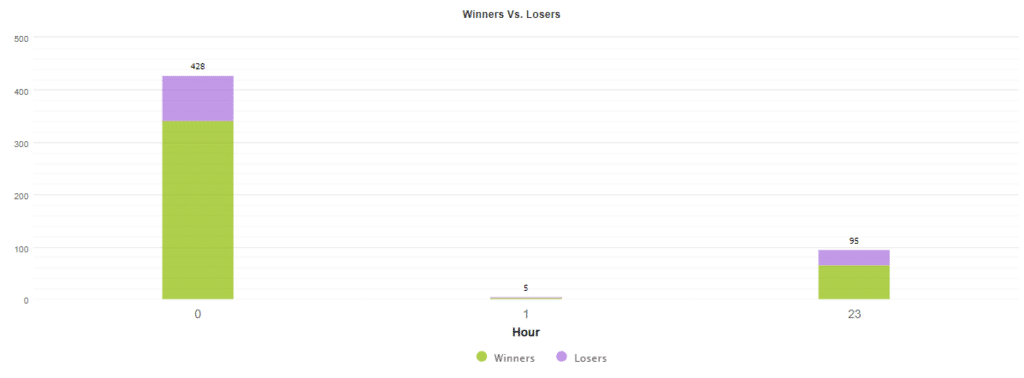

The night session is the most actively traded.

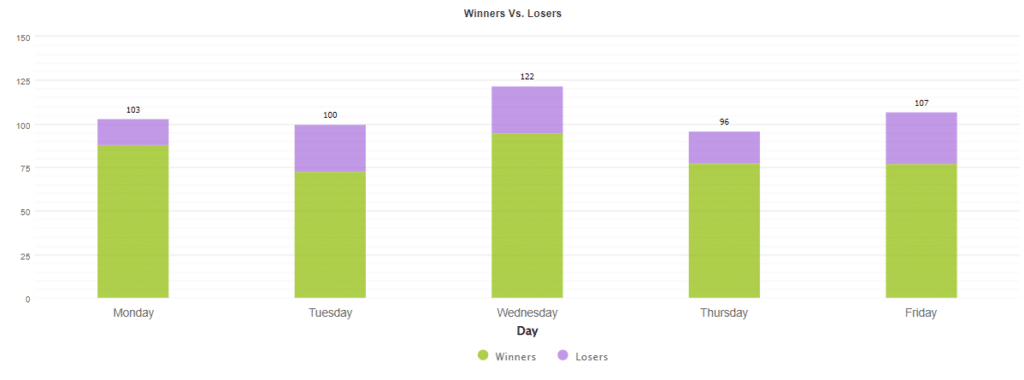

The system trades almost equally during a week.

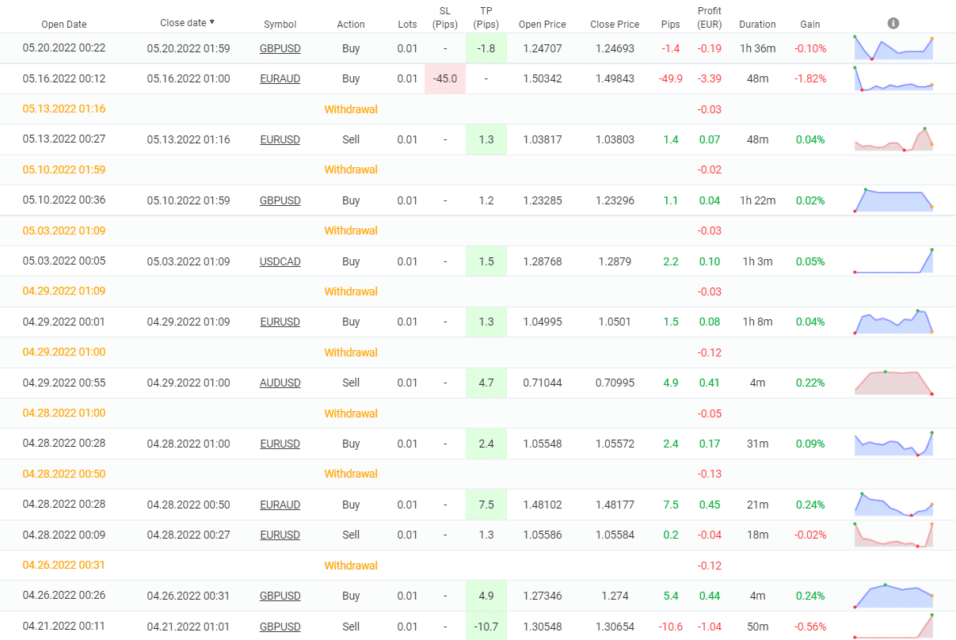

We may note that the system works with huge SL levels.

The system doesn’t look profitable in May 2022.

GerFX Density Scalper price

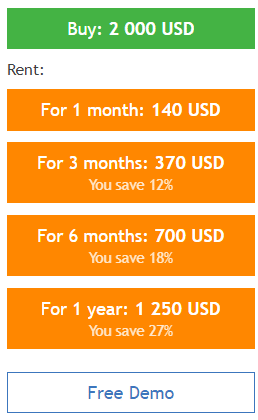

The current price is huge, $2000 compared with the similar solutions on MQL5. We can subscribe for it for $140/month, $370/3 months, $700,/6 months, and$1250/year. Traders can also download it for demo usage.

Customer support

The developer provides average support among other robot designers on MQL5.

Are traders happy with GerFX Density Scalper?

Now, clients are happy because the system works stable and profitable.

People say that GerFX Density Scalper is …

Good. The presentation includes plenty of positive reviews. So, people are happy to use this system.

GerFX Density Scalper

GerFX Density Scalper-

Profitability4/5 Good

-

Strategy3/5 Neutral

-

Reliability4/5 Good

-

Price2/5 Bad

-

Customer Testimonials5/5 Amazing

Advantages

- A backtest report provided

- Tradin results shown

- Positive testimonials written

Disadvantages

- No risk advice given

- The robot shows that the system requires customization