GALILEO FX is a Forex expert advisor that claims to help you beat the market. According to the developer, this robot has an accuracy of 96.46% and it has been tested in different market conditions. There is zero information on the parent company behind this robot. Their Myfxbook profile tells us that they are located somewhere in Ireland. We don’t know when the company was founded or whether it has built other trading systems in the past.

The highlights of GALILEO FX

These are the main features of this system:

Compatible with all brokers

GALILEO FX is not a broker-sensitive EA. Different brokerage firms have different parameters and trading conditions that can affect your profits. However, you can make this expert advisor work with any broker of your choice.

Loss protection

This is one of the features the vendor has highlighted on the website. However, they haven’t explained it properly. We don’t know what techniques the robot uses for shielding the account against heavy losses. However, as we can see from the live statistics and backtests, the EA exhibits a high level of drawdown.

Fully automated

This EA can function without any manual inputs. You can complete the installation in less than 1 minute after purchasing the robot and downloading it.

Trading strategy of GALILEO FX

Unfortunately, there is no explanation for the trading strategy used by this expert advisor. We don’t know what indicator it uses or how it identifies profitable trades. There are three versions of this robot, namely Personal, Plus, and Pro. For Personal and Plus, the maximum profits are $1000/month and $5000/month, respectively. The Pro plan comes with unlimited profits. The vendor suggests starting with a minimum deposit of $100.

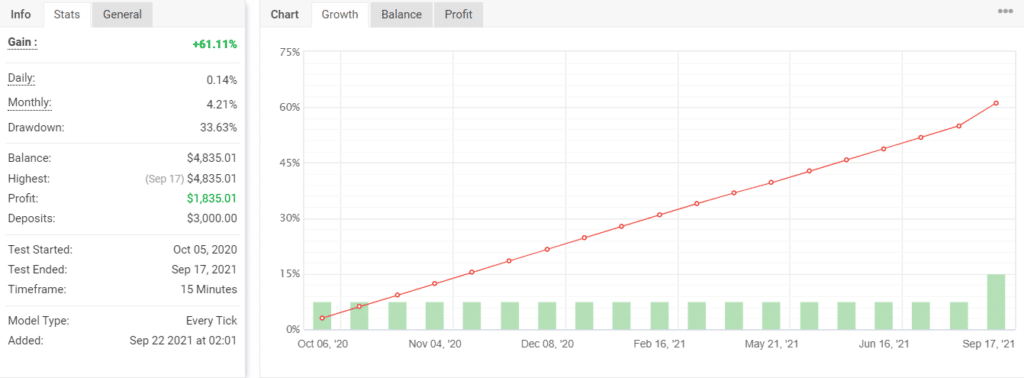

Backtesting reports

This backtest was conducted from October 05, 2020, to September 17, 2021. The testing period is too short and the EA conducted only 20 trades during this period which is quite odd. It won all of the trades and generated a total profit of $1835.01.

The daily and monthly profits for this test were 0.14% and 4.21% respectively, while drawdown was quite high at 33.63%. Looking at the high drawdown, we can tell that the EA was following a risky strategy.

Trading results in real time

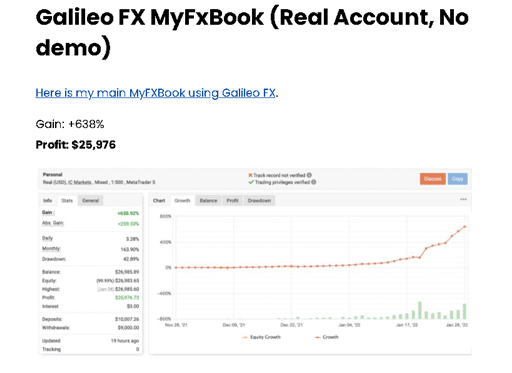

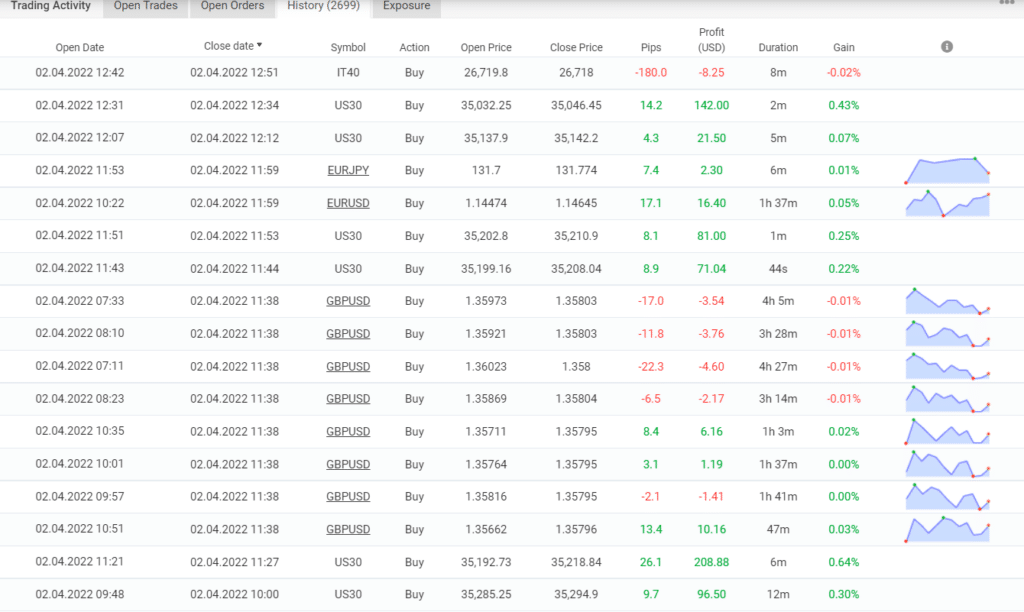

Oddly enough, there are no live trading accounts in the official Myfxbook profile of this EA, only backtests. By conducting our own research, we found this account that belongs to one of the users of this robot. It was launched on November 28, 2021, and to date, the robot has conducted 2681 trades through it. Therefore, it is clear that GALILEO FX follows a high-frequency strategy.

The daily and monthly gains for this account are 3.61% and 187.22%, respectively. Here, the drawdown is even higher than the backtest at 42.89%. The total profit currently stands at $37,188.12 while the profit factor is 3.10.

Here you can see the recent trades conducted through this account. We can see that the EA is prone to losing multiple trades and in certain cases, it only generates minor profits. It keeps its trades open for a few minutes usually, but sometimes it can take a few hours. The average win and loss for this account are 144.38 pips / $30.54 and -161.32 pips / -$19.8, respectively.

GALILEO FX price

The prices for the Personal, Plus and Pro plans are $249.39, $623.55, and $1121.26, respectively. While the first plan is affordable, the rest are quite expensive. Also, the vendor does not have a refund policy in place.

Customer support

If you are in need of assistance, you can send a mail to the email address shared on the website.

Are traders happy with GALILEO FX?

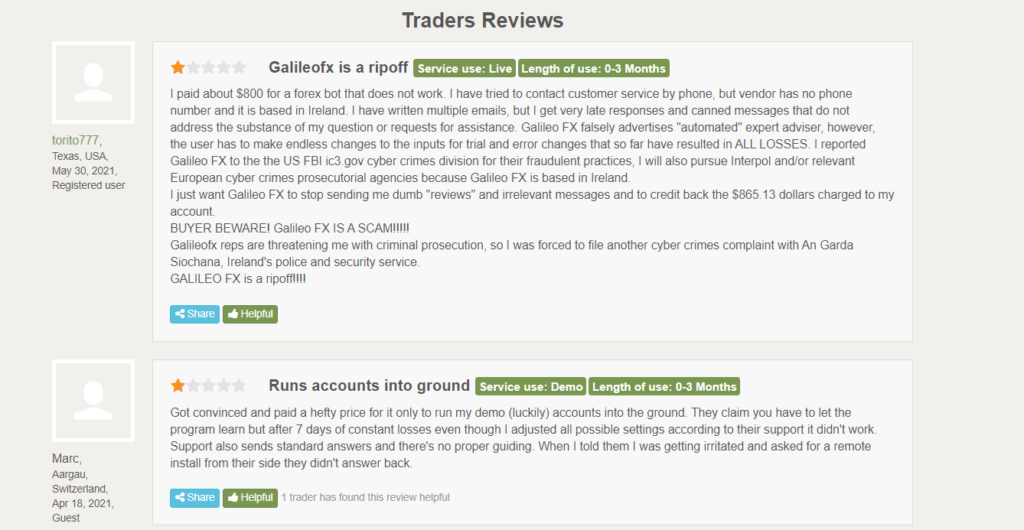

On Forexpeacearmy, there are a few reviews for this expert advisor. One user has complained about receiving late responses from the support team. Another user has claimed to have suffered constant losses with this robot.

GALILEO FX

GALILEO FX-

Profitability3/5 Neutral

-

Strategy2/5 Bad

-

Reliability2/5 Bad

-

Price2/5 Bad

-

Customer Testimonials2/5 Bad

Advantages

- Works with all brokers

- Loss protection feature

Disadvantages

- No money-back guarantee

- High drawdown

- Lack of vendor transparency