FX Deal Club is a Forex managed account service that lets you get started with a small deposit. The trading team behind this platform has been active since 2001. According to the vendor, the team continuously improves its strategy and strives to deliver at the highest level.

The team members have over 21 years of combined financial experience. There is no background information on the traders and developers, but we know that the company is based in Dubai, UAE. It is unknown whether this team has built similar systems in the past.

The highlights of FX Deal Club

According to the developer, these are the main features of the system:

User-friendly service

Anyone can get started with this platform even if they don’t have prior trading experience. All you need to do is to fund your trading account and share your MT4 credentials. The promised monthly ROI is 30-50%, based on the account size.

Highly secure

FX Deal Club takes measures to mitigate risk while managing the user’s funds. It diversifies the portfolio and uses smart hedging to maintain a favorable risk/reward ratio.

Low drawdown

The developer claims that the average drawdown for this system is only 5-20%. They have mentioned that the maximum limit is 40%. The system has an equity protection feature, but we are not sure how it functions.

Small minimum investment

You can get started with a small deposit of $500. Nevertheless, the vendor recommends using $5000 or above for higher profits.

Trading strategy of FX Deal Club

The trading strategy of this system is based on daily trends and price action. The team conducts detailed fundamental technical analysis for placing the orders. It keeps an eye on the markets 24/7 to find the most lucrative trading occasions.

Backtesting reports

Backtests are carried out in a simulated environment using several years’ worth of data, thus revealing the long-term performance. Unfortunately, the vendor has not shared the backtesting results for this system.

Trading results in real time

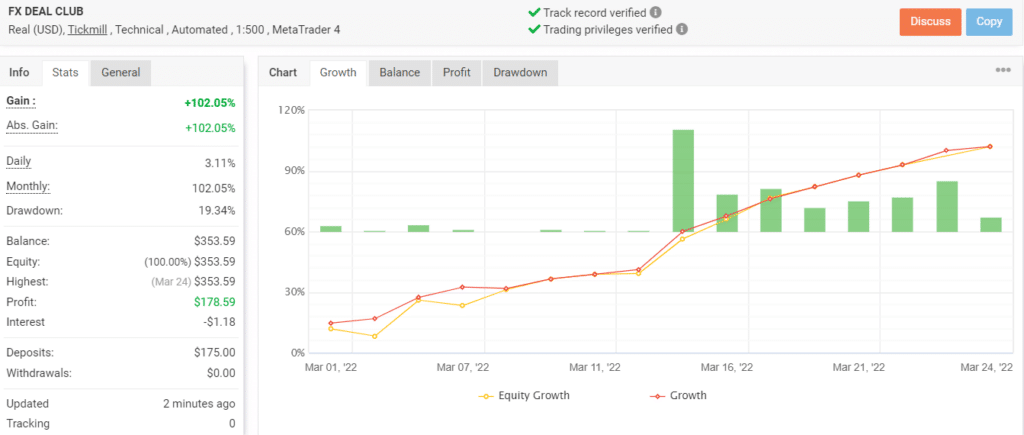

This trading account on Myfxbook has been active since March 01, 2022. To date, only 78 trades have been placed through this account. The trading history is too short and it is difficult to accurately gauge the profitability by studying the results.

At this moment, the win rate for the account is quite high at 79% and the total profit is $178.59. In the short time that it has been active, the account has managed a time-weighted return of 102.05%. While the daily and monthly gains are 3.11% and 102.05% respectively, the drawdown of 19.34% is within the acceptable limit. This account has a very high profit factor of 4.49, but we should remember that it is only based on 78 trades.

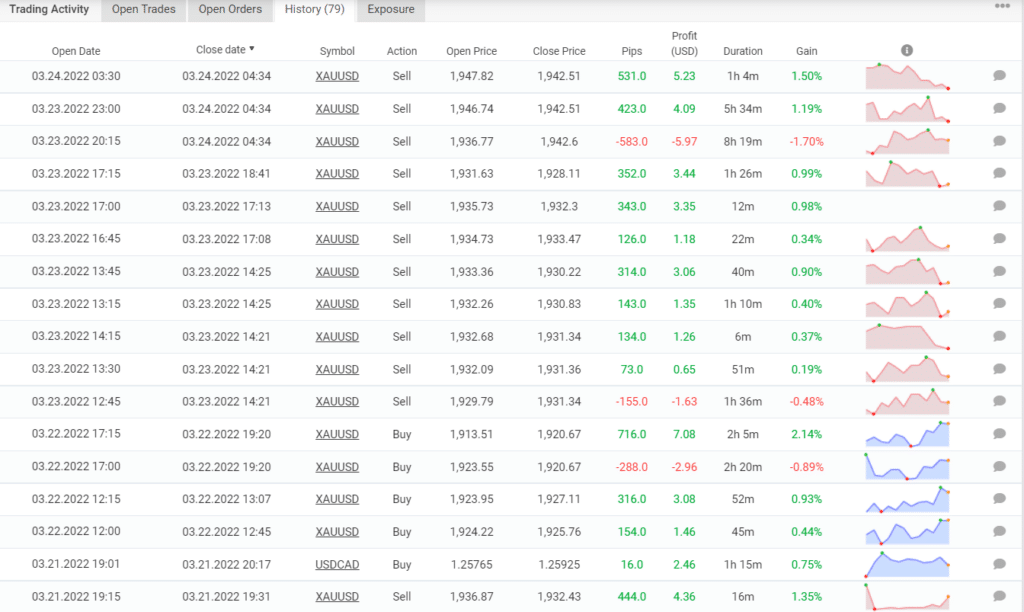

Here we can see the recent trades conducted through this account. The system places a large number of orders on a daily basis, extracting small profits from each. It is clear that it does not follow a risky strategy, since the losing occasions are quite infrequent. The average trade length is 10 hours and 53 minutes, while the average win and loss are 176.80 pips/$3.70 and -98.78 pips/-$3.19, respectively.

FX Deal Club price

Unlike most other services, there are no subscription plans for FX Deal Club. The company charges a 35% profit share each week following the high water mark rule. Each user receives the invoice to their email every week. The accepted payment modes include Bitcoin, Skrill, and Paypal. With this pricing model, you don’t need to pay any fee if you don’t make profits. The vendor does not have a refund policy in place.

Customer support

There is a contact form on the website using which you can send a message to the service team. Alternatively, you can use the official email address to contact support.

Are traders happy with FX Deal Club?

There are only 3 reviews for this system of Forex Peace Army. Here, the users have praised the performance of the account managers.

FX Deal Club

FX Deal Club-

Profitability4/5 Good

-

Strategy3/5 Neutral

-

Reliability3/5 Neutral

-

Price3/5 Neutral

-

Customer Testimonials4/5 Good

Advantages

- Positive reviews

Disadvantages

- Short trading history

- No backtesting results

- Lack of vendor transparency