Forex Robotron is an expert advisor that works on the MT4 platform and deals in several currency pairs. The latest version of this robot was released in April 2021. It is a trading system that places around 600 trades on a yearly basis.

On the official website, there is no information on the parent company. We don’t have any official contact information and the vendor has not revealed the identities of the team members. It is unclear whether this company has built other systems in the past. The lack of vendor transparency is quite disappointing and it creates a poor first impression.

The highlights of Forex Robotron

The principal features of Forex Robotron are as follows:

Broker friendly

Forex Robotron is not a broker-sensitive system. You can use it with US Brokers, non- US brokers, and even Islamic-friendly brokers. The system automatically adjusts to 4 and 5 digit brokers.

Trades in multiple currency pairs

Forex Robotron can trade in pairs like EUR/USD, EUR/GBP, EUR/CHF, EUR/CAD, and EUR/AUD. Generally, EAs that trade in one or two pairs are more reliable because they have specialized trading schemes.

No arbitrage, martingale, grid, or hedging

According to the vendor, this robot avoids dangerous strategies like arbitrage, martingale, grid, and hedging. However, looking at the high drawdown exhibited during real-time trading, it is obvious that the trading scheme followed by Forex Robotron is just as risky.

Trading strategy of Forex Robotron

Forex Robotron works on the M5 timeframe. It gives you the option to cease trading during the weekend. As per vendor claims, the system has been tested with real slippage and real variable spreads, as well as trade commissions of $7 per lot, per round turn. When you purchase this EA, you get unlimited licenses for all your MT4 accounts. The vendor also provides you with step-by-step setup instructions.

Unfortunately, we don’t have any information on the trading strategy utilized by Forex Robotron. The vendor has not mentioned what indicators this system uses or whether it trades the trend or against it. Due to the lack of strategy insight, it becomes difficult for us to trust this system. A Forex trader would have difficulties determining whether the robot suits their trading style.

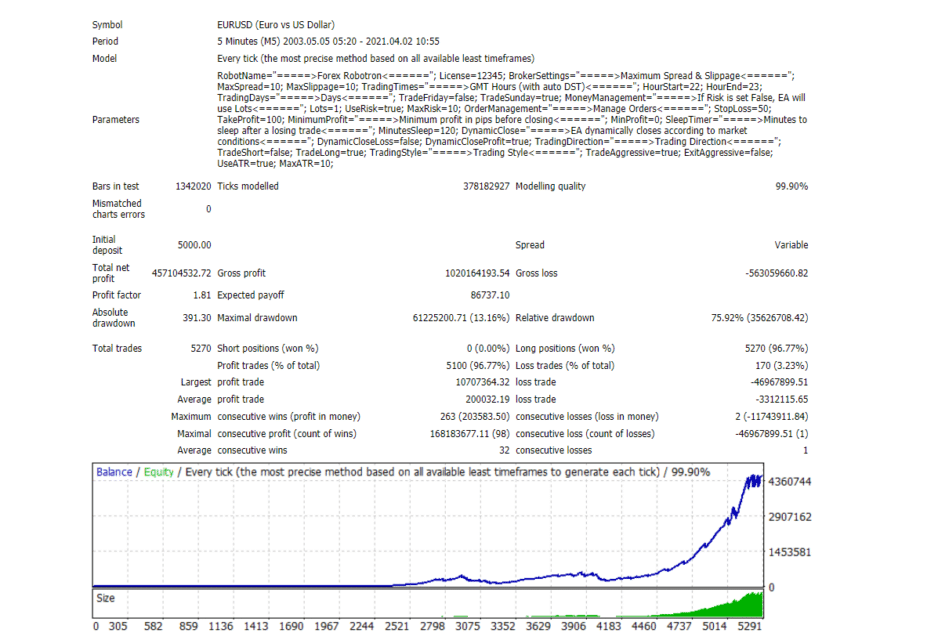

Backtesting reports

Here we have the results of a backtest conducted on EUR/USD conducted from 2003 and 2021. During this time period, the EA placed a total of 5270 trades, winning 5100 out of them. This means it had a win rate of 96.77%. The total profit generated for this backtest was $457104532.72.

For this backtest, Forex Robotron managed 263 maximum consecutive wins and 2 maximum consecutive losses. It had a high relative drawdown of 75.92%, and this is an indication of a risky strategy that can drain your account.

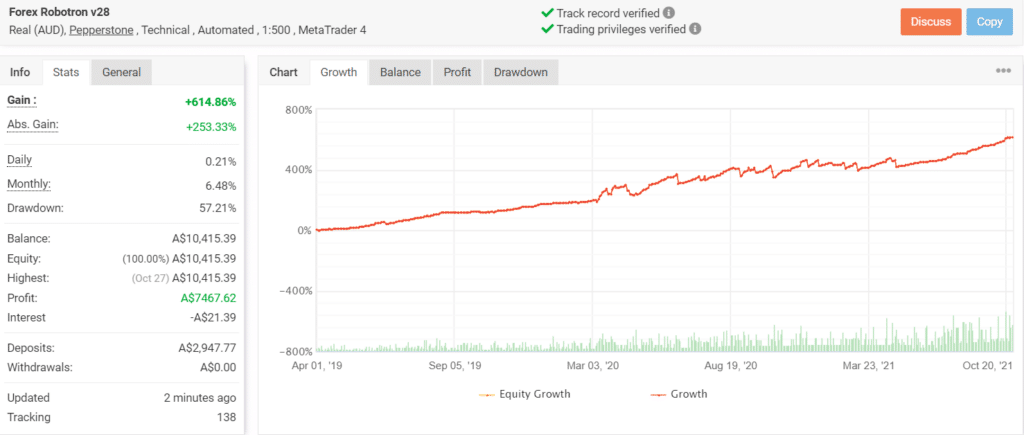

Trading results in real time

This trading account on Myfxbook was launched on July 23, 2018. To date, the EA placed 1158 trades through this account, and currently, it has a win rate of 81%. Compared to the backtest, the win rate is a bit low. After making deposits of A$2947.77, it has made a profit of A$7467.62.

The daily and monthly gains for this account are 0.21% and 6.48%, respectively. Here also, we can see a high drawdown of 57.21%. Clearly, the robot follows a trading scheme that has a high risk of ruin.

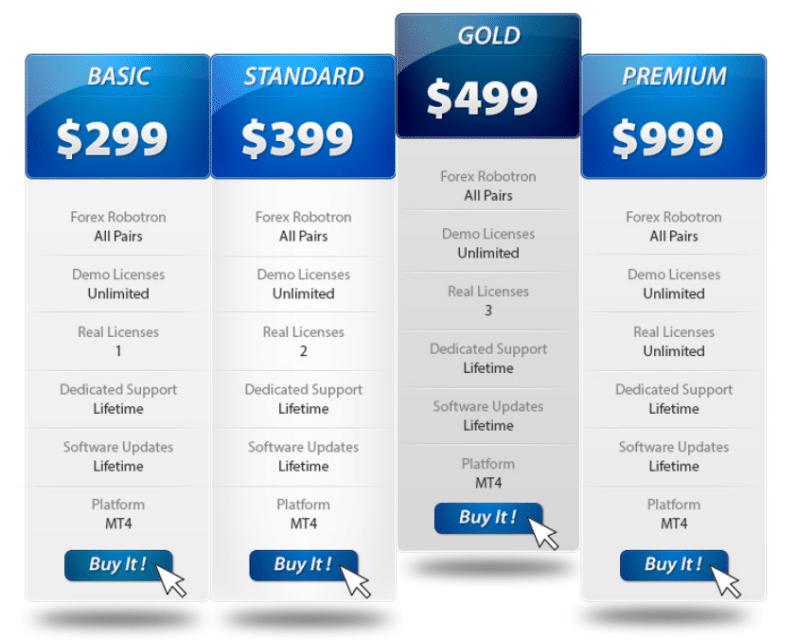

Forex Robotron price

There are four distinct pricing plans for Forex Robotron. The Basic plan costs $299 and it provides you with 1 real license. For 2 software licenses, you can purchase the Standard plan that costs $399. With the Gold plan, you get 3 real licenses in exchange for $499. Finally, there is the Premium plan offering unlimited real licenses for $999. The plans are not at all cheap and the vendor does not entertain refund requests.

Are traders happy with Forex Robotron?

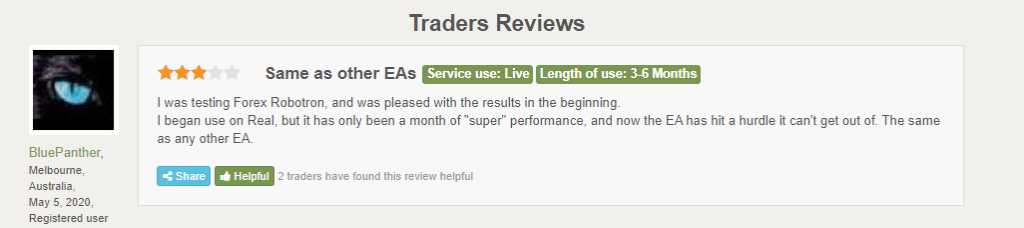

There are no reviews for this EA on Trustpilot. On Forexpeacearmy, there is a single review from a customer, where they claim that the system started off well, but after one month of live trading, its performance deteriorated.

Forex Robotron

Forex Robotron-

Profitability1/5 Awfully

-

Strategy1/5 Awfully

-

Reliability2/5 Bad

-

Price3/5 Neutral

-

Customer Testimonials2/5 Bad

Advantages

- Verified trading results

Disadvantages

- High drawdown

- No money-back guarantee

- Lack of strategy insight