Falcor Forex Robot is marketed as a lean, mean, trading algorithm with advanced features and a magnificent logic that makes it a top performer. The robot wants to assist you to manage your charts in the live market efficiently. However, is it as good as described? Let’s find out.

Forex Robot Trader is the vendor behind this trading system. The company was launched in 2006 by an individual called Don Steinitz. As years went by, more programmers joined the company. Now, their goal is to offer the best Forex trading bots and indicators to trade the market. The other tools created include Odin, Waverunner, Vader, Hedge, Volatility, and more.

The highlights of Falcor Forex Robot

Below you will find some characteristics of the robot which the vendor thinks differentiates it from others:

Completely automated system

The system looks for, locates, manages, and closes all trades automatically.

No lagging indicators

The robot finds large trades in real-time utilizing advanced price action methods.

Innovative new code for 2022

Falcor applies a new trading logic, which the trading community used to think was too complicated for an EA.

All account sizes

It doesn’t matter what account size you have as the robot is compatible with micro, mini, and full size lots and works on them with no problem.

Brains and beauty

Much effort has been put into ensuring that the robot looks presentable. The vendor doesn’t include hideous disorderly charts on it.

Trades 24 hours daily

Falcor trades day and night, so you will hardly miss a trading opportunity again.

Multiple currency pairs

The system is flexible as it can work with any mixture of currency pairs.

Trading strategy of Falcor Forex Robot

This robot relies on price action to trade. Unlike other systems that base their decisions on past price data, Falcor studies current prices to find trading signals. This gets rid of delays and lag. The vendor informs us that the system trades frequently and prefers to have a trading position most of the time, so you never miss an opportunity to make profits. It also implements an automatic stop and a reverse if the direction of the price changes suddenly.

Backtesting reports

There are no backtest results for Falcor on its official site. It is still not clear why the vendor has downplayed this data. The test is vital as it enables traders to monitor the performance of their tool by assessing past trading patterns.

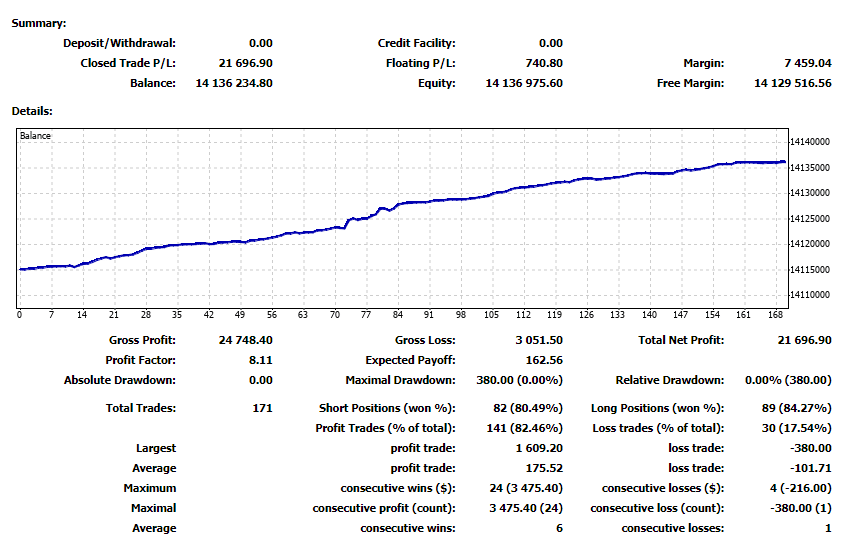

Trading results in real time

Live trading stats are available. They have been produced by the vendor and are hence not from a credible site such as FXStats, FXBlue, and Myfxbook.

The data above shows the robot’s performance in February. So far, it has completed 171 trades, a sign that it is very active. Each trade must be bringing in huge profits, given that the current net profit is $21696.90. The profit factor of 8.11 also portrays Falcor as a very productive system. There are success rates of 80.49% for short and 84.27% for long positions. The drawdown is still zero.

Falcor Forex Robot price

The system is currently priced at $79. This pricing is indeed cheap, considering that the vendor wants us to believe that it is running a million dollar account. We could not find any money-back guarantee on the sales pitch.

Customer support

The EA has an online support center, which the vendor says is a great resource of information and useful guides. So, you can visit the page, type, and submit your request. A member of the support team will respond as soon as possible. A FAQ page is also available, and you can go through it to see if it covers some of the questions you have regarding the EA.

Are traders happy with Falcor Forex Robot?

Falcor doesn’t have credible customer reviews. The few testimonials available on the official site cannot be easily trusted since they haven’t been verified by a third party.

Falcor Forex Robot

Falcor Forex Robot-

Profitability2/5 Bad

-

Strategy3/5 Neutral

-

Reliability3/5 Neutral

-

Price4/5 Good

-

Customer testimonials2/5 Bad

Advantages

- Supports all account sizes

- Trades automatically 24 hours

Disadvantages

- No credible client feedback

- Unsubstantiated live results

- Lack of backtest data

- Insufficient vendor transparency