Adaptive EA is a flexible trading system that can trade on any instrument. You are advised to run it on a tester to learn how it really works. The EA was built by Svetlana Visnepolschi. Not much is known about this developer, only that he lives in the US. He hasn’t even created any other trading tools yet.

The highlights of Adaptive EA

Here are some distinctive features of the system:

Support for many trading instruments

Adaptive is designed to trade any currency pair, crypto coin, metal, or oil.

Risk management system

The EA’s settings include trailing stops, take profit and stop loss sizes in pips to help the trader maximize their income and reduce losses.

Order restriction

The system normally prohibits the user from opening buy/sell orders.

Process adaptation every time

This feature works by overwriting the neural network in any case, even with a forward test.

Trading strategy of Adaptive EA

Based on the EA’s parameters, it is clear that it works with grids of orders. Our analysis of the system has also led us to discover that the martingale algorithm is also integrated into it. This latter approach entails doubling the user’s size when they suffer a loss. The idea behind it is that the trader will regain their losses when they win trades.

Backtesting reports

The developer doesn’t supply the public with the system’s backtesting reports. Rather, he features a video tutorial that illustrates how users can backtest this algorithm themselves.

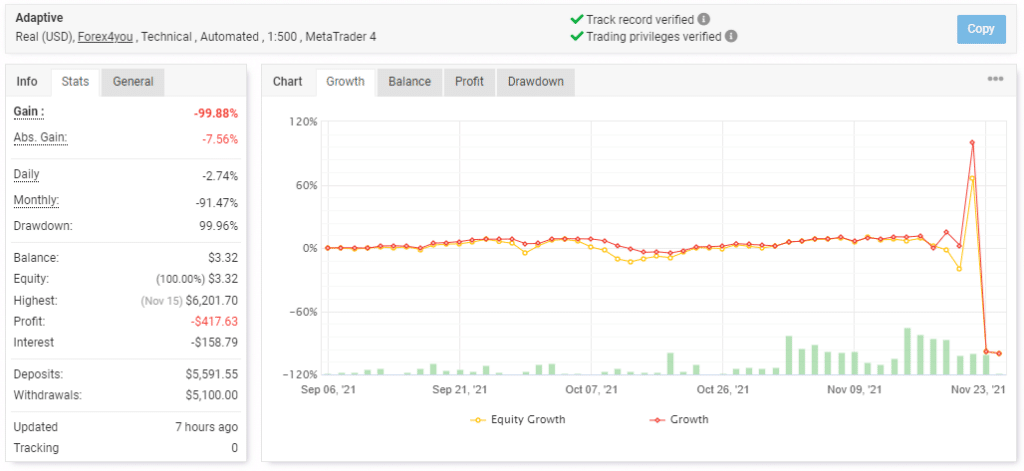

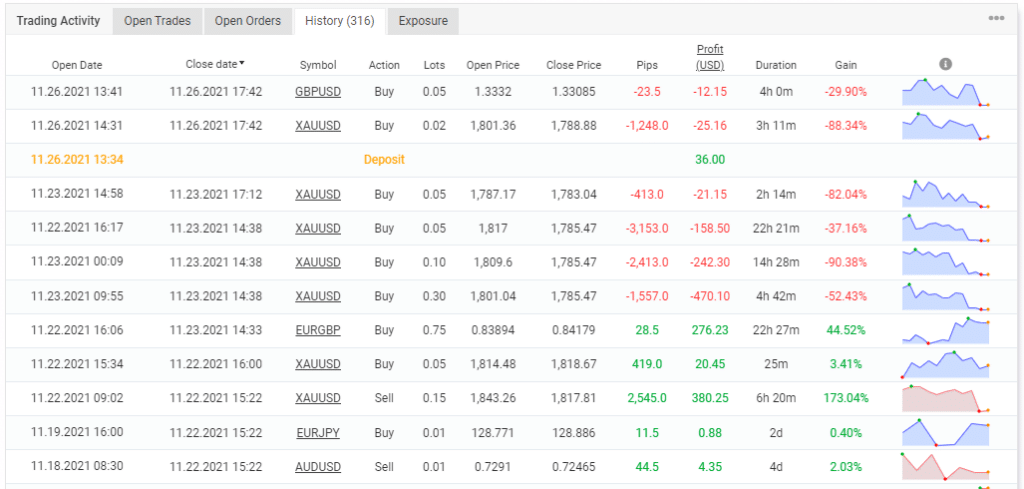

Trading results in real time

At a glance, we can see that this account is not doing well. It was opened about 8 months ago, and for this period, the system has managed to decrease its value by -99.88%. For now, the EA is not making any revenues for the owner as it has a negative monthly profitability rate of -91.47%. The losses have accumulated to reach -$417.63. The drawdown is extremely high at 99.96%. So, there is no hope of salvaging this account. No wonder the owner has withdrawn $5100 already to avoid losing all their investment.

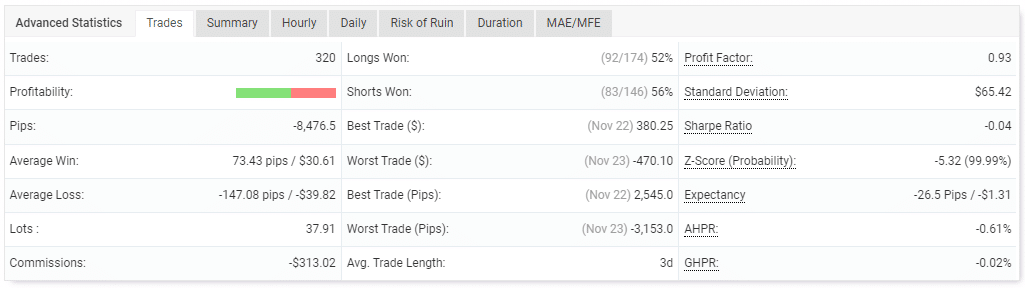

To date, the system has executed 320 trades with 37.91 lots. Its loss rate is very high. That’s why we have a very large average loss (-147.08 pips) compared to the average win (73.43 pips). The win rates for long and short positions are also very poor at 52% and 56%, respectively. The profit factor is less than 1, a sign that the account is currently operating at a loss.

The EA’s high losing streak is apparent here. The grid and martingale strategies are evident.

Adaptive EA price

The current retail price of this EA is $185. This price tag is fair and makes the product easily accessible to traders. A money-back guarantee is not on offer.

Customer support

The developer doesn’t tell us how he provides customer support. He neither lists his email nor his phone number. Nevertheless, the common method traders use to communicate their concerns regarding an EA on MQL5 is through the comments section.

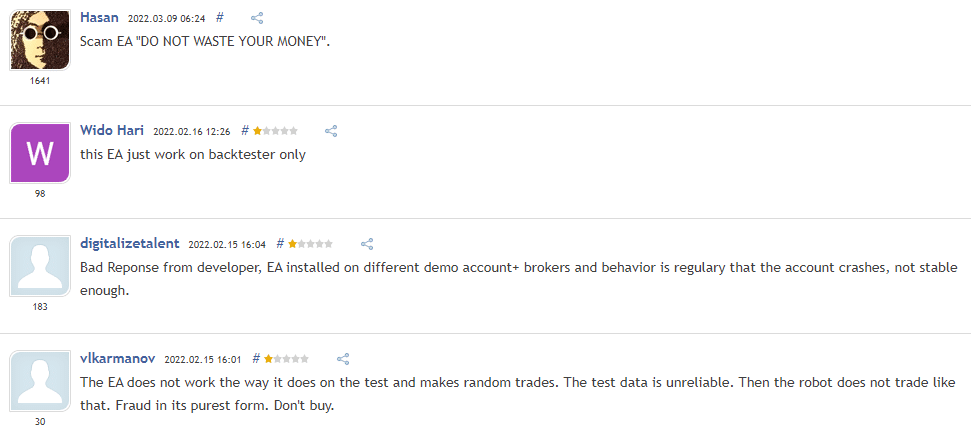

Are traders happy with Adaptive EA?

Most traders are not satisfied with this system. Out of the 8 reviews users have posted on MQL5, only 2 are positive. The majority intimate that the system’s strategy is ineffective. These comments agree with the trading outcomes Adaptive has generated on Myfxbook.

Adaptive EA

Adaptive EA-

Profitability2/5 Bad

-

Strategy2/5 Bad

-

Reliability2/5 Bad

-

Price4/5 Good

-

Customer testimonials2/5 Bad

Advantages

- Fair pricing

- Support more multiple trading instruments

- Easy to use

Disadvantages

- Negative reviews

- Lack of backtest report

- Poor trading outcomes

- Grid and martingale on the board